Food Inflation Outlook - June 2025

- Eric Karlson

- Jul 19, 2025

- 3 min read

The CPI and PPI numbers for grocery were published this week and things are looking good on the horizon. With the continual tariff uncertainty and consumer sentiment angst, we continue to see minimal impact on food prices. We are starting to see tariffs hitting some industries like furniture and electronics and more expectations of higher prices as inventories are reduced. Looking specifically at food inflation, we are paying particular attention to Mexico tariffs where the brunt of US imported fresh food is sourced. Mexico has been playing the Trump tariff game pretty well, so tariffs were expected to be low, but the President recently said Mexico would be hit with a 30% tariff, which is only slightly less than Canada, who has largely been giving Trump the finger.

With all this uncertainty, I think most people have been over reacting because Trump brings out such strong emotions in people. I do not see tariffs having a significant long term impact on food inflation. It is just not good for the current administration to be hiking food prices ahead of mid term elections. As such, I expect the administration will continue to push and work with Mexico to keep food import prices reasonable.

The current all country food import index is looking very good. It spiked in anticipation of higher prices but has been trending down over the next six months. The index is currently lower than when Trump took office. So even with the constant hand-wringing, the data is showing food import prices falling.

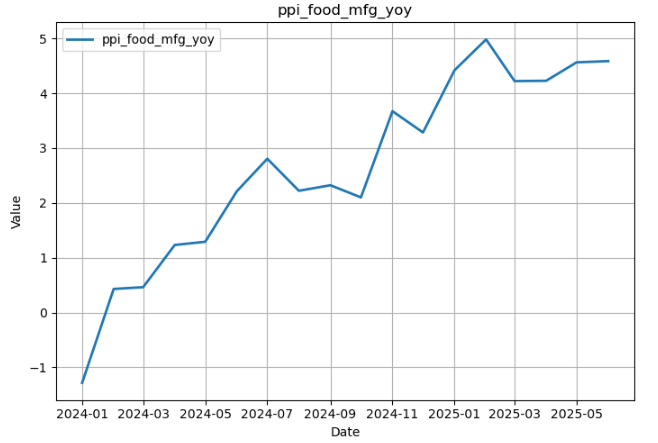

Looking at the other inputs for food inflation - oil prices, farm products, food manufacture, and grocery margins - the data is all trending favorably.

Oil did rebound from very large declines due to Middle East geopolitics but is still down 15% YOY. Farm products peaked early in 2025 at 15% but have come down to 5% and appear to be leveling out. Food Manufacture, which has the biggest impact on food inflation, is also leveling out at 5%. Grocery margins are leveling out at 2%. With most inputs flattening out, we expect CPI FAH to flatten out and be more predictable, assuming nothing too crazy happens with tariffs.

Looking at the CPI FAH home trend, it appears to be flattening out over the last few months in the 2.0% to 2.4% range. Our forecast expects it will tick up another 25 basis points in the next few months, but overall we are in the Goldilocks range since it is not too hot and not too cold.

Moving onto the forecast, we can see how the forecast (dotted line) has been performing versus the actuals (blue line). The last few months were missing on the high side but that gap has closed. Much of the high side miss was due to Food Manufacture prices which were growing significantly but did not translate as much as expected into higher food prices.

Viewing the running forecast below, we can see how the forecasts have evolved as the inputs have evolved. Our initial forecast in February (blue), we see a very scary forecast which was driven by all input increasing and was in the middle of heated tariff talks in the media. It was looking like we might be headed for much higher food inflation. Even potentially hitting the 4% to 5%, which would start to weight on units.

Then in April (red) we saw the inputs starting to soften and so did the forecast. The subsequent forecasts are all largely trending along those lines. The most recent forecast (grey) is showing a peak CPI FAH in July at about 2.6% and then coming down to 2.0% ot 2.5% by the end of the year.

This is consistent with current food inflation trends. CPI FAH YOY is 2.1% YTD and the forecast is for 2.3% YOY for 2025. Again, as we have said in the last few CPI FAH posts, things look good despite all of the noise in the media, the consumer sentiment, and the tariff chaos. This could change but we do not expect significant changes over the long term. Consequently, we can take a breath and follow the data. The data will tell us when there is trouble on the horizon.

Comments